Guidelines for the FAOR Periodic Budgetary Report (PBR)

The purpose of this document is to assist FAOR Offices in preparing the Periodic Budgetary Report (PBR).

This exercise comprises:

- Review of the Data Warehouse (DW) Transaction Listing

- Planning of forecast expenditures until the year-end

- Preparing a PBR in COIN

- Correction of wrong charges

Review of the Data Warehouse (DW) Transaction Listing

The purpose of the Transaction Listing review is to:

- Ensure that all local expenditure were correctly reflected in the TL in GRMS against the correct Activity code and expenditure account.

- Identify any incorrect/improper charge posted against the FAORs' budget for correction

NB: Particular attention should be paid to the prior year's unliquidated obligations (ULOs) which are posted in the TL as a credit against the current year budget. The review of the ULOs should ensure that relevant expenditure have been correctly charged against them. (Parameters to run an Expenditure Transaction Listing)

Planning of forecast until the year-end

The proper and regular use of the Financial Commitments module can greatly facilitate the determination of accurate forecast. In fact, many local expenditures, especially those under the General Operating Expenses account, are recurrent by nature and can be forecast with a very good level of approximation. (Guidelines on forecast expenditures)

Preparing a PBR in COIN

The Budget Management module in COIN enables FAORs to manage their Regular Programme budget. In particular:

- it provides updated information on the FAOR financial situation for the current and past financial years,

- it allows the on-line preparation of the Periodic Budgetary Report (PBR), including the requests for additional funds, as necessary, and

- through an electronic workflow, it transmits the PBRs to the responsible Regional Office for review and action, as appropriate.

All necessary guidelines on the use of the module are available in the COIN user manual (Click here for the Budget Management guidelines http://coin.fao.org/cms/en/coinmanual/CountriesOffices/FAORBudgetManagement.html).

Correction of wrong charges

Corrective actions should be taken to reverse wrong charges posted to your office budget and identified when reviewing the DW Transaction Listing:

- Incorrect charges posted should be corrected using a Transaction Adjustment.

- Incorrect charges should be promptly brought to the attention of the initiator for immediate corrective action. A copy of the message to the transaction initiator should be sent to the Regional Office for any required follow up.

All security-related expenditures are charged to a different Chapter of the Programme of Work and Budget and, therefore, should not be included in the PBR of the Representation but sent to DDOS.

PARAMETERS TO RUN AN EXPENDITURE TRANSACTION LISTING

The following parameters should be entered in the DW to run an Expenditure Transaction Listing:

Organization Level |

GROUP |

Organization |

The office organizational code e.g. FAIND for FAOR in India |

RP Activity level |

BIENNIAL OUTPUT |

RP Activity |

RAR………….. |

Layout of Transaction listing |

LONG DESCRIPTION |

Expense Account level |

CHILD ACCOUNTS |

Expense Account type |

NON STAFF |

Display Single Account at a time |

NO |

From period |

January of current year |

To Period |

Current month |

Activity Range |

ALL LESS ARREARS |

GUIDELINES FOR THE FORECASTING EXERCISE

The following guidelines can facilitate the forecasting exercise for each budget account available to FAORs.

Income planning

FAO Representations should ensure that the income planning is evaluated in an adequate manner for the following items:

- GCCC

- AOS income

- Secondments

- Sale of surplus

Non-staff Resources Planning

- 5013 Consultants

Funds against this budget account are allocated on an ad hoc" basis. However, it is possible that expenditures are incurred without an allocation in accordance with the fungibility rules. In both cases the forecast would be equal to that portion of the honorarium still payable to the consultant/s. - 5020 Locally Contracted Labour

This budget account covers three distinct types of expenditure: - Overtime (MS325)

According to MS325.22 overtime in excess of 25 hours per month requires the prior approval of the Department Head (the Regional Office in case of FAORs). Wherever possible overtime should be compensated through compensatory leave rather than cash payment. Furthermore, overtime for work related to projects should be proportionately charged against their budgets.

Some overtime can be forecast to cover special requirements during peak periods. However, given the current limitation of budgetary resources, every effort should be made to reduce the overtime to the minimum. This can be achieved through a more effective work re-distribution in the office. - Casual Labour

Forecast for casual labour should be made in those cases where the requirement to hire temporary staff (for example due to the prolonged absence of a staff member) is already known. The same recommendations for the overtime are applicable in this case. - Salary supplement to Government provided staff

The salary supplement payable to the Government provided staff is set at the beginning of the year and is valid for the entire year. Therefore, the forecast corresponds to the total salary supplement payable for the remaining months of the year.

- 5021 Duty Travel

This budget account covers the official travel of the FAO Representation within the area of accreditation. Therefore, it should be possible to program these missions for the entire year taking into account the volume of the programme as well as the available amount. Cost-sharing with projects should be arranged wherever possible. The forecast includes the cost of ticket, DSA and terminals. - 5023 Training

The funds for staff training are segregated from the regular FAOR allotment and posted against a different activity code. They are not fungible i.e. they can only be spent for investing in staff development. However the training funds could be increased by rephasing other unspent accounts, or by AOS funds, or by making the request to the Regional Office for additional and justified funds; in the latter it will depend on funds availability at central level. Any unspent funds against this account will be surrendered. Therefore, it is essential to prepare at the beginning of each year a comprehensive training plan which takes into account the staff needs and the allocated amount. The costs associated with training plan represent the forecast against this budget account. - 5024 Expendable Procurement

This budget account covers all procurement of office supplies and other material/equipment which is not recorded in the Organization Fixed Assets records as their value is lower than US$1,500 equivalent and are not of an attractive nature. Attractive items (see list) which value exceeds US$500 are recorded in the Organization Fixed Assets.

Items not included in the Organization inventory may be recorded in the Local Inventory module in COIN.

Forecasting against this account should be based on the normal consumption of office supplies (paper, pen, pencils, and stationery in general). This is an area where austerity measures could be introduced to achieving the required savings.

- 5025 Non Expendable Procurement

No budgetary allocation is normally given at the beginning of the year for the procurement of non expendable equipment. Allocations are approved by Regional Office on an ad hoc basis following a detailed and justified request submitted by the FAOR. However, non expendable items can be procured without prior approval from the Regional Office if their cost can be covered from within the overall allotment.

In both cases the forecast is equal to the cost of the equipment as per the supplier's quotation. - 5026 Hospitality

The fungibility principle does not extend to the hospitality budget. Therefore, the maximum allowed expenditure corresponds to the budget level. Forecasting against this budget account may be unrealistic as it is difficult to plan in advance the events relating hospitality. Unspent Hospitality funds could be rephased to other accounts, particularly the contribution to UN activities or special initiatives to enhance FAORs advocacy capacity mentioned in the paragraph below. - 5028 General Operating Expenses

Most of the expenditure against this budget account is of a recurring nature and therefore funds can be easily programmed and earmarked. Cost sharing with projects should be arranged wherever possible.

In those cases where local contracts have been stipulated for the procurement of services (rental of premises, cleaning, IT etc) the forecast corresponds to the amount still to be paid until year end according to the terms of the contracts.

This budget account covers a variety of expenditure accounts. It is recommended to reduce the actual usage of accounts to the following expenditure accounts:

- 6152 Miscellaneous

Used to charge all GOE not specifically covered by one of the other accounts. Forecasting against this account may not be feasible due to its generic nature. - 6175 Vehicles Operation and Maintenance

Forecasting against this expenditure account should be based on historical data relating to operations and maintenance of the official vehicles, adjusted based on current cost levels. For this purpose it is essential to maintain an accurate logbook of vehicle maintenance and fuel/oil consumption in COIN. (Click here for the COIN User Manual for vehicle log book)

In addition, it is recommended to arrange for regular vehicle maintenance possibly through a service contract with a local workshop to ensure smooth and more economical operations as well as to be able to effectively plan your budgetary funds. A contingency amount should be set aside to cover for unexpected requirements - 6176 Operation and Maintenance of Equipment

Same as above for vehicles. Obsolete equipment should be disposed in order to make available additional storing space as well as to possibly obtain some proceeds of sale which would be credited against the office's budget. - 6177 Other Operating Costs

This expenditure account is not very much utilized by the FAO Representations. Forecast should be provided if applicable and be based on prior periodsexperience. - 6178 Electricity

- 6180 Heating/Air-Conditioning Fuels

- 6182 Other Utilities

Forecast against these expenditure accounts should be based on prior periods consumption eventually adjusted for revised rates. If procurement commitments have been set up at the beginning of the year for these utilities, the forecast should be equal to their outstanding balances. This is an area where it could be possible to implement austerity measures to reduce consumption and make savings. - 6190 Other Communications

- 6251 Courier Services

- 6252 Data Lines (internet)

- 6255 Telephone Costs

Also for these four accounts the forecast should be based on historical data. For this purpose, setting up procurement commitments at the beginning of the year for each major communication service is highly recommended. In addition, the practice of charging project's budgets for any cost directly attributable to them should be strictly followed. Furthermore, it is essential to achieve a prompt recovery of any telephone call or other communication cost of private nature. - 5040 General Overhead Expenses

This budget account is used for back-charging the cost of items ordered from HQ and eventual Pouch recoveries. In the past this account used to be charged also for the email costs. However, this practice has now been abandoned and email costs are covered at corporate level. Therefore, the forecast against this account is mainly set based on the average cost of items ordered by your office from HQ and an estimate of Pouch recoveries based on previous-years expenditures.

The AOS income target modality

Current modality:

The budget modality requires the establishment of “Income Targets” for all divisions/offices

at headquarters and in the field at all levels (Regional/Subregional Offices, FAORs) for any

income they are expected to earn. These targets are set as negative income amounts and

are included in the yearly allotment of all Budget Holders.

New modality:

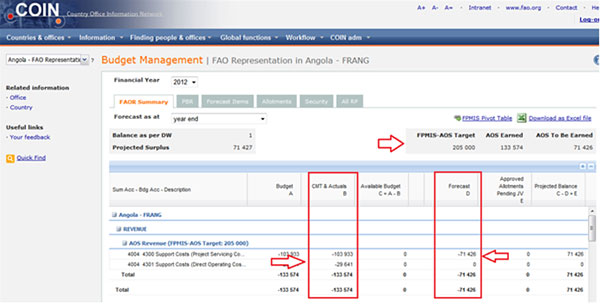

The FAOR Budget Management module in COIN (see sample screenshot below) displays the office’s AOS income target as automatically calculated by FPMIS (i.e. the sum of all AOS forecast income calculated project by project). FAORs should check that the calculation of AOS is in accordance with the applied support cost rate reflected in FPMIS. This is to ensure that the AOS earnings data derived from FPMIS are accurate since, especially in cases of reduced PSC rate, the FAORs may not be eligible to receive AOS share.

It is also be possible to view the monthly AOS movements, i.e. the credits posted on a monthly basis and the balance of the income still to be earned. The income target in COIN is for information only, i.e. it will not be reflected as part of the country office budget (as a negative income) but only as forecast. Also, in Oracle/DW, the AOS income target remains aggregated at the regional level, while AOS credits will be posted at country office level, therefore allowing the FAORs to utilize directly their AOS resources.

As part of good financial planning practice, FAORs should make certain that anticipated

AOS income that will for sure be earned must be spent within the year and especially by the

end of the biennium to avoid large under-expenditures.

The “Forecast AOS Income”, reflected in the FAOR Financial Situation, will be automatically

calculated in COIN as the difference between the AOS income target extracted from FPMIS

and the AOS earnings credited as Actuals in Oracle/DW. In this respect, AOS earnings are

be credited directly to the FAOR office allotment in the Revenue Section/Support Cost accounts when the project is of national coverage (FAOR as Budget Holder and AOS Emergency national). When an Emergency project is of subregional or regional coverage, the AOS earnings will be credited at regional level. When the Emergency project is of interregional or global coverage, the AOS earnings will also be credited at regional level.

AOS Planning

The ROs are responsible for aggregate planning and monitoring of AOS resources as well as

for support on issues related to the AOS targets available in COIN, to ensure that income

is always in line with planned expenditures.

The AOS income target represents the level of AOS income that the FAOR office is committed to earn during the year. It is based on the FAOR’s own delivery estimates posted in FPMIS and the specific AOS rule applicable to each project.

The AOS income target at country office level as reflected in COIN is

refreshed automatically from FPMIS on a daily basis and, therefore, will change as the

Budget Holder modifies the delivery estimates in FPMIS. For this reason, it is important toupdate the data in FPMIS as soon as there are expected changes in the delivery estimates.

The FAORs should periodically review the AOS income target amount in FPMIS and plan

expenditures according to the adjusted income target and the related forecast.

The “AOS income target” translates into potential resources available to the country office on condition that projects are delivered as planned and in accordance with the FAOR’s delivery estimates in FPMIS as verified and checked. The FAOR will be in a position to monitor the trend by comparing the actual AOS earnings against the set target as displayed in COIN.

Implementation and Monitoring - At country office level, it is

important to carefully monitor the delivery estimates, the actual AOS income posted, and the expenditures so as to ensure that total expenditure does not exceed the sum of the RP allotment and the AOS income earnings. Taking into consideration that some financial information aggregated at country office level is available only in COIN (as highlighted in the section above), the budget monitoring at

country office level will be most appropriately performed through the COIN Budget Management module

designed explicitly to help FAORs, and the Regional Offices as Budget Holders for their regions, to monitor the budget at country office level.

The AOS resources are fully fungible, like Regular programme funds AOS resources should be utilized by the FAOR as office manager for activities in support of an approved, results-based workplan.

Changes in Oracle and DataWarehouse

The AOS income target and corresponding budget as given by OSP on the Net

Appropriation allotment under budget account 4004 at regional level, and it is not

distributed at country office level. At country office level, the

AOS income target will be reflected in COINas an indication of the

current AOS income target calculated by FPMIS as the sum of all forecast AOS amounts

calculated project by project). This AOS income target will impact on the Forecast AOS

Income column and forecast balance that will be automatically calculated in COIN based on

the difference between the AOS income target, automatically extracted from FPMIS, and the

AOS earnings effectively credited as Actuals in Oracle (see screen below).

Postings of actual income earned are made on a monthly basis directly by OSP/CSF against the Revenue Section/Support Cost accounts according to the geographical coverage as explained in the section above (National; Emergency: national, subregional, regional, interregional and global). Expenditure will be posted by the offices against the one prevailing activity code for each region to be used for both RP and AOS resources.

The “AOS Income Target” (income to be earned) in COIN is shown in a special separate field (upper right corner) as extracted from FPMIS. The following example illustrates this modality:

Staff positions funded by AOS income

Both AOS and RP charges are posted against

the same activity code. This implies that AOS-funded post are no longer traceable in

GRMS, and cannot be differentiated from the other established posts. Therefore,

monitoring in Oracle/DW of the AOS income against these hard commitments is no longer

possible. Since Budget Holders must ensure that they earn sufficient resources to cover the

cost of these AOS-funded posts, and in order to allow the monitoring at FAOR level, the

AOS posts will be manually flagged in COIN by the Regional Offices. A COIN module on

‘AOS posts’ has been developed in order to allow the manual flagging.

When AOS-funded posts are established, the corresponding hard commitments amounts are displayed at country level under staff expenses as Non-PWB salaries ( not in DW). The portion of the target that is to be committed for staff will no longer be available for planning. It is, therefore, important that adequate AOS income flows into the Revenue/Support Cost accounts section to cover the costs of these AOS funded posts. AOS-funded positions for which adequate funding cannot be secured should be terminated or funded with other extra-budgetary resources. Any uncovered AOS income-funded position will result in a reduction of the individual RP allotment to compensate for the deficit. As positions other than those funded by the Regular Programme are extended on a yearly basis, in October each year, each RO will have to request the FAORs to provide assurance of funding for the subsequent year prior to extending the post(s).

Note that the AOS Income Target, the Forecast AOS Income, and the Hard Commitments of AOS funded posts are only displayed in COIN and not in Oracle/DW.

Carry-overs:

Any income earned during the year becomes part of the Regular programme and as such, any unutilized balance by the end of the year, would be carried over. Any unspent balance at the end of the biennium will be lost.

Other Issues:

Regarding regional/subregional or other projects for which the FAOR has received

delegation of authority from the Budget Holder, please note that no automatic AOS

reimbursement mechanism is in place. If this delegation translates into a significant

increase in workload, the country office is encouraged to negotiate a reimbursement

directly with the Budget Holder. In the case of Emergency projects, the respective roles of the FAOR and the

Emergency Coordinator can be used as a basis to determine the level of reimbursement to

be negotiated. At the same time, it has to be noted that 7% of the AOS income generated

by all emergency projects is credited to the FAOR network at the regional level in recognition

of their role in the implementation of those projects.

Contacts for assistance:

- For any question relating to FPMIS, please refer to TCDM, [email protected].

- For any question relating to Project Servicing Cost postings, please refer to OSP, Mr. Elkhan Aliyev ([email protected])

- For any question related to Administrative and Operational Support costs (AOS) please refer to the Focal Point in the relevant Regional Office or Mrs. Bintia Stephen Tchicaya ([email protected]) in OSD.